Yesterday a good article was published on the Harvard Business Review site with insights on small businesses and the COVID-19 crisis along with some recommendations. The article is titled A Way Forward for Small Businesses by Bartik, Bertrand, Cullen, Glaeser, Luca, and Stanton.

The article is worth a read and here are a few excerpts.

In detail the authors offer five recommendations for navigating the current crisis, but here’s the quick list:

- Don’t rush your decisions, but do make plans.

- Get in line for the Paycheck Protection Program now.

- Figure out how your customers’ needs have changed.

- Do some realistic accounting.

- Keep your best employees loyal.

Over the past few weeks, the authors surveyed 5,800 U.S. small businesses. Key findings, most not surprising, include:

- “Large numbers of small businesses have shut down and laid off huge numbers of workers. … 45% of small businesses were temporarily closed due to Covid-19. Total employment by these businesses declined by 40% since the end of January.”

- “Most small businesses are extremely cash strapped. The vast majority of small businesses had less than two months of cash on hand to deal with shocks. The median business with monthly expenses over $10,000 generally didn’t even have enough cash to cover two weeks of their spending.”

- “A majority think they will be able to reopen by the end of 2020, but a large minority are less certain. Roughly 60% of respondents expect to be able to reopen by the end of 2020. However, nearly 30% view it only as somewhat likely that they will be able to reopen, and almost 10% find it unlikely or extremely unlikely that they will be back in business by year end.”

- “Small businesses disagree (a lot) about how long the crisis will last. Perhaps the biggest unknowns for businesses…is precisely how long the ongoing disruptions will last. More than a third of businesses in our survey thought that disruptions would be over by June. But another third thought that the disruptions would last beyond August…”

- “Many businesses are unsure about whether the CARES Act loans will work for them. While many businesses are in dire need of a cash infusion, our survey also found that many businesses do not plan to seek assistance. Businesses were concerned about whether they would qualify. They were unsure about whether they would be able to repay the loans, or whether the government would end up forgiving the loans. They were worried about the complexity of the process and the hassle involved in getting a loan.”

As noted above, the article is worth reading.

# # #

The Chamber teamed up with other chambers and economic development organizations recently on a couple of things.

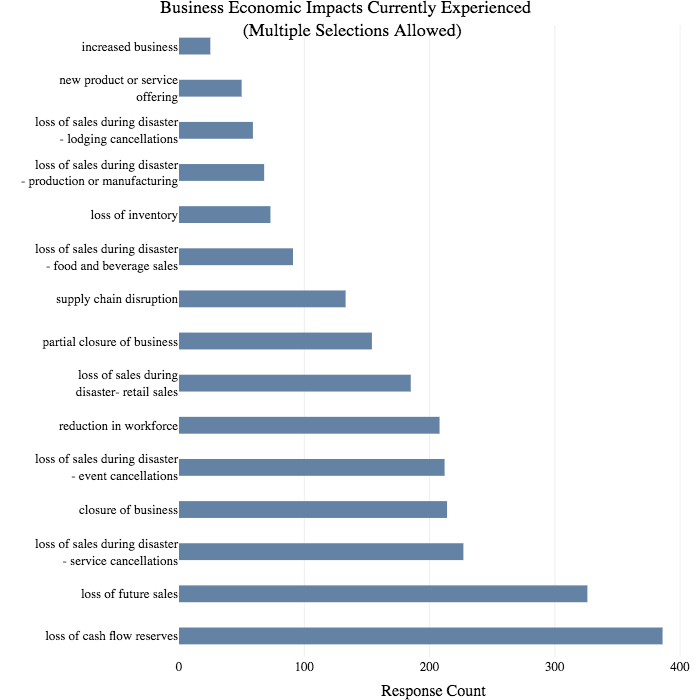

- We conducted a survey of companies in Larimer and Weld counties. Here is some data from the Larimer side of the region about the business impacts of the coronavirus shutdown:

- We also teamed up to create a one-stop place for business for COVID-19 response information. The new site is NoCoRecovers.com and it is a wealth of information about resources available for businesses in the area.