Fort Collins-based Brinkman Real Estate has been executing on a strategic expansion throughout the Intermountain West region since Q1 of 2021. In that time, they have executed on nearly $250 million in transaction volume, expanded to eight new markets, and risen as one of the most active buyers in several of those markets.

The company’s year-over-year total assets under management increased from $300 million to $475 million with the multifamily assets under management tripling in that time. The company continues to focus on adding core-plus and value-add multifamily properties to their portfolio.

“Multifamily continues to be a strong asset class,” said CoFounder and CEO, Kevin Brinkman. “We’re steadfast in our strategy of following population trends into high-growth markets where we can create a win-win for residents and investors.”

The company shifted its primary service model from development to acquisitions in late 2020 when construction prices rose at an alarming rate, presenting challenges for multifamily developers. Since then, their laser focus on investment in high-growth markets has taken the company to five new states, as well as additional secondary markets in Colorado.

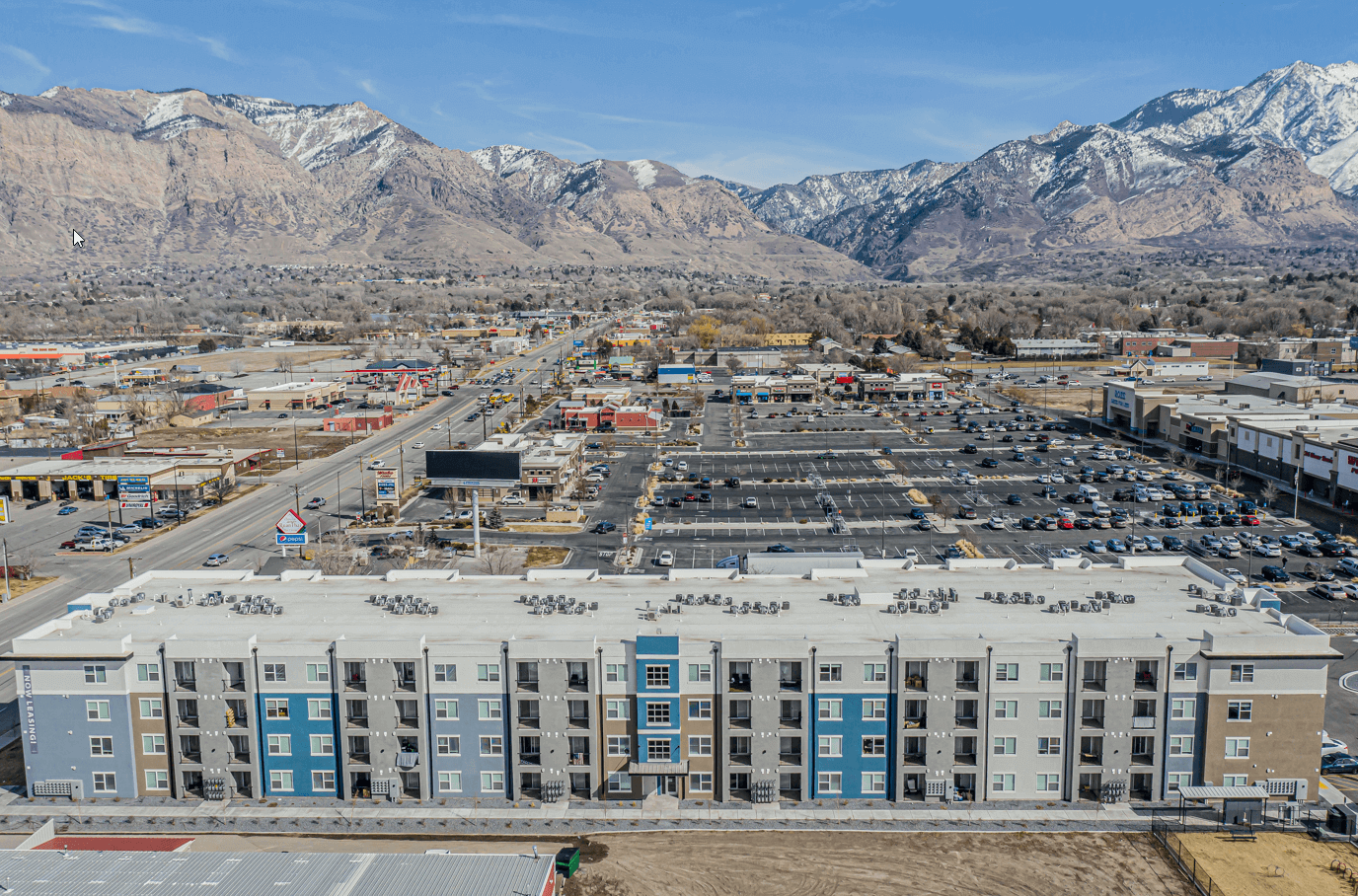

Brinkman Real Estate’s most recent acquisitions include properties in Ogden, Utah, Albuquerque, N.M. and Salem, Ore. While their current portfolio includes a diversity in assets, the company sees the multifamily sector as the biggest opportunity within the current economic landscape.

Brinkman’s portfolio includes more than $560 million in investment volume with zero losses.

About Brinkman Real Estate

Brinkman Real Estate provides strategic insight and access to property investment opportunities throughout the Intermountain West. Our approach balances purpose with profit to acquire and activate properties to increase comfort for tenants while maximizing predictability and return for investors. Brinkman’s investment portfolio includes diverse assets from multifamily, mixed-use, office, hospitality and retail. We are a certified B Corp and have received such industry honors as NAIOP Deal of the Year Finalist, NAIOP Innovative Project of the Year Finalist, Governor’s Award for Downtown Excellence, Colorado Companies to Watch, and Colorado State University Real Estate Hall of Fame.

For more information about Brinkman, visit www.BrinkmanRE.com.